Money management can be daunting, especially if you’re not a financial expert. With the rise of fintech apps, managing your finances has become more accessible. These apps offer a range of features that can help you keep track of your expenses, make informed investment decisions, and even improve your credit score. But with so many apps on the market, it can be challenging to choose the right one.

According to recent research, the global financial technology market is projected to reach a market value of approximately $324 billion by 2026.

That’s where this blog post comes in. This post will explore the 20+ features of a fintech app for personal finance management. These features are critical to ensuring that your chosen app is effective and meets your financial needs.

Some key features we’ll cover include automated savings plans, bill tracking, credit monitoring, investment tracking, and personalized financial advice. We’ll also explore how these features can help you achieve your financial goals, whether paying off debt, saving for a down payment on a house, or investing in retirement.

Whether you’re new to the world of personal finance or a seasoned investor, a fintech app can help you take control of your finances and achieve financial freedom. With the right app and features, you can make informed financial decisions, build wealth, and live the life you’ve always dreamed of. So, let’s dive into the top 20+ features of a fintech app for personal finance management and start taking control of our financial futures!

What Categories of Fintech Apps Exist?

You’ll be able to decide more wisely if you have a better understanding of the different FinTech apps that are available. Creating a FinTech mobile application is difficult, but you must first select the appropriate app type. So, let us dive into the realm of FinTech mobile apps!

- Payment and Money Transfer Apps: These apps enable users to make online payments, transfer money domestically or internationally, split bills, and manage their finances. Examples include PayPal, Venmo, Zelle, and Cash App.

- Personal Finance Management Apps: These apps help users track their income, expenses, savings, investments, and budgets. They may also offer features of a fintech app like financial goal-setting, bill tracking, and investment tracking. Examples include Mint, PocketGuard, YNAB (You Need a Budget), and Personal Capital.

- Lending and Borrowing Apps: These apps facilitate borrowing and lending activities, including peer-to-peer (P2P) lending, microloans, and crowdfunding. They may also offer credit scoring and loan management tools. Examples include LendingClub, Prosper, Kiva, and Kickstarter.

- Investment and Wealth Management Apps: These apps allow users to invest in stocks, bonds, mutual funds, and other investment vehicles. They may provide robo-advisory services, portfolio tracking, and financial planning tools. Examples include Robinhood, Acorns, Wealthfront, and Betterment.

- Cryptocurrency and Blockchain Apps: These apps enable users to buy, sell, and manage cryptocurrencies, such as Bitcoin, Ethereum, etc. They may also provide wallet, price tracking, and blockchain-based financial services. Examples include Coinbase, Binance, Ledger, and Mycelium.

- Financial Education and Literacy Apps: These apps provide educational content and tools to help users improve their financial literacy, including budgeting, investing, and retirement planning. Examples include LearnVest, NerdWallet, Investopedia, and MoneyLion.

- Small Business and Entrepreneurship Apps: These apps cater to the financial needs of small businesses and entrepreneurs, offering features of a fintech app such as accounting, invoicing, payroll management, and business lending. Examples include QuickBooks, Square, Stripe, and Kabbage.

- Insurance and Risk Management Apps: These apps offer insurance-related services, such as insurance comparison, policy management, and claims processing. Examples include Lemonade, Policygenius, Oscar, and Root.

- Crowdfunding and Fundraising Apps: These apps facilitate crowdfunding campaigns, donations, and fundraising efforts for various causes, projects, and organizations. Examples include Kickstarter, GoFundMe, Indiegogo, and Patreon.

- Regulatory and Compliance Apps: These apps help businesses and individuals comply with financial regulations, such as anti-money laundering (AML), know-your-customer (KYC), and data privacy requirements. Examples include IdentityMind, Trulioo, and Compliance.ai.

Features of a Fintech App

Here are some of the common features of a fintech app, along with their explanation:

1. User-friendly interface:

A user-friendly interface is an essential features of a fintech app. It refers to the app’s design and layout, which is easy to use and navigate for users, regardless of their level of technical expertise. Additionally, it should be responsive and optimized for various screen sizes and devices, including smartphones, tablets, and desktop computers.

2. Account Management:

With account management, users can check their account balances, view transaction history, and monitor spending. The features of a fintech app also enables users to transfer money between their accounts or to other people, schedule bill payments, and set up automatic savings plans.

3. Budgeting Tools:

Budgeting Tools are a crucial features of a fintech app that helps users manage their finances effectively. It allows users to track their income, expenses, and savings and create a budget that aligns with their financial goals.

4. Personalized Financial Advice:

Another essential features of a fintech app is Personalized Financial Advice, which provides users with tailored financial advice based on their unique financial situation, goals, and risk tolerance. The advice can include saving more, investing wisely, managing debt, and improving credit scores.

5. Bill Payment:

One of the most useful features of a fintech app is bill payment for users with multiple bills to pay, as it can help them keep track of all their bills in one place. It can also save time and money, as users don’t need to go to a physical location to pay their bills or pay postage and checks. Additionally, Bill Payment can help users avoid late fees and maintain their credit scores by ensuring that bills are paid on time.

6. Investment Management:

The investment management features of a fintech app can be a powerful tool for users looking to invest their money and grow their wealth. However, it is important for users to carefully consider their investment goals and risk tolerance before making any investment decisions and to seek professional financial advice if necessary.

7. Financial Planning:

The app should offer financial planning tools that help users create a financial plan and track progress toward their goals. For example, a user can input information about a potential investment and simulate how that investment would perform over time based on different variables, such as interest rates, market volatility, and economic trends. This can help users make informed decisions about their investments.

8. Credit Score Monitoring:

Credit score monitoring is a valuable features of a fintech app because it empowers users to take control of their credit score, understand how their financial behavior affects it, and protect themselves against errors and fraud.

9. Expense Tracking:

Expense tracking can be especially useful for people who have trouble managing their finances or want to understand their spending habits better. Using a fintech app with expense tracking features, users can take control of their finances and make better financial decisions.

10. Mobile Check Deposit:

Mobile Check Deposit is a secure features of a fintech app that often includes additional security measures such as encryption and authentication to keep the user’s financial information safe. This feature has become increasingly popular in recent years, particularly with the rise of mobile banking, and is now a standard feature of most fintech apps.

11. Money Transfer:

The app should allow users to transfer money between accounts and to other people. These features of a fintech app allow users to send and receive money without needing physical cash or checks. It is also convenient for businesses to pay their vendors or suppliers.

12. Security:

A fintech app should have robust security features to protect user data, such as two-factor authentication, data encryption, and biometric authentication, like facial recognition or fingerprint scanning. These features of a fintech app help ensure that only authorized users can access the app and their financial information.

13. Notification and Alerts:

Notifications and alerts are essential features of a fintech app as they help users stay on top of their financial transactions and activities. Fintech apps use notifications and alerts to inform users of important events, such as low account balances, upcoming payments, or suspicious activity on their accounts.

14. AI and Machine Learning:

Artificial Intelligence (AI) and Machine Learning (ML) are becoming increasingly important in the world of fintech. They enable financial service providers to automate and personalize the delivery of financial products and services to their customers, enhancing the customer experience while improving efficiency and reducing costs.

15. Rewards and Incentives:

Rewards and incentives are one of the features of a fintech app that encourages users to engage with the app and make financial transactions. This feature offers users rewards, bonuses, or points for completing specific tasks or achieving certain milestones.

16. Financial Education:

The app should offer financial education resources like articles, videos, and tutorials to help users improve their financial literacy. In addition, financial education can help users better understand the benefits and features of a fintech app itself. By explaining how the app works, what features are available, and how users can get the most out of it, fintech apps can help users maximize the app’s value and achieve their financial goals.

17. Customer Support:

Providing customer support services in a fintech app ensures user satisfaction, builds trust, and increases user retention. By providing timely and helpful support services, fintech apps can demonstrate their commitment to their users’ financial well-being and help them achieve their financial goals.

18. Third-Party Integrations:

Third-party integrations are a valuable feature for fintech apps, as they enhance the app’s functionality and provide users with a more comprehensive financial management experience.

19. Transaction History:

Access to transaction history within a fintech app can be very convenient for users. It eliminates the need to keep paper receipts or log into multiple financial accounts to track transactions. Instead, users can view their transaction history within the app, often with features like search or filter options, to quickly find specific transactions or view transactions within a specific date range.

20. Multiple Language Support:

When a fintech app offers multiple language support, users can choose their preferred language during registration or in the app settings. These features of a fintech app ensures that the user interface, menu options, and app content are displayed in the user’s preferred language.

Why Develop a Fintech App for Your Business?

Developing a fintech app for your business can offer a range of benefits, depending on your specific needs and goals. Here are some reasons why developing a fintech app can be advantageous for your business:

- Enhanced Customer Experience: Fintech apps can provide a seamless and convenient user experience, allowing your customers to easily access and manage their financial services, make payments, track expenses, invest, and more. This can lead to increased customer satisfaction and loyalty and attract new customers who value the convenience and efficiency of digital financial services.

- Increased Efficiency and Automation: Fintech apps can streamline financial processes, automate tasks, and reduce manual errors, resulting in increased operational efficiency and cost savings for your business. For example, payment and invoicing apps can simplify transaction processes, while personal finance management apps can automate budgeting and financial tracking.

- Access to New Markets: Fintech apps can enable your business to reach new markets and customers, especially digitally-savvy individuals who prefer online or mobile banking and financial services. This can help you expand your customer base, tap into underserved or unbanked populations, and expand your business beyond traditional geographical boundaries.

- Innovation and Competitive Advantage: Developing a fintech app can demonstrate your business’s commitment to innovation, giving you a competitive advantage over traditional financial institutions that may still rely on traditional methods. By leveraging technology to provide innovative financial services, you can differentiate your business from competitors and position yourself as a leader in the industry.

- Data-driven Insights: Fintech apps generate a wealth of data on user behavior, transactions, and preferences, which can provide valuable insights for your business. By analyzing this data, you can better understand your customers, their financial needs, and market trends, which can inform your business strategies and decision-making.

- Flexibility and Scalability: Fintech apps can be developed with flexibility and scalability, allowing you to adapt and evolve your services based on changing customer needs, market trends, and regulatory requirements. This can give you the agility to respond quickly to market changes and scale your business as it grows.

- Potential Revenue Generation: Fintech apps can offer various revenue generation opportunities, such as transaction fees, subscription models, referral fees, and data monetization. Depending on your business model and monetization strategy, a fintech app can be a potential source of revenue and contribute to your business’s bottom line.

It’s important to note that developing a fintech app requires careful planning, execution, and compliance with applicable regulations. It’s crucial to thoroughly understand the financial services regulatory landscape, security requirements, and legal considerations to ensure compliance and mitigate risks. Consulting with legal, regulatory, and technology experts is recommended to ensure a successful fintech app development journey for your business.

Fintech App Development: A Step-by-Step Guide

Developing a fintech app can be a complex process that requires careful planning and execution. Here is a step-by-step guide to help you navigate the fintech app development process:

| Step 1 | Define Your Objectives and Identify Target Users |

| Step 2 | Develop a Business Plan |

| Step 3 | Choose the Right Technology Stack |

| Step 4 | Design User Experience (UX) and User Interface (UI) |

| Step 5 | Develop the Backend and Frontend |

| Step 6 | Implement Security Measures |

| Step 7 | Test and Optimize |

| Step 8 | Obtain Necessary Regulatory Approvals |

| Step 9 | Launch and Market Your App |

| Step 10 | Monitor, Update, and Improve |

Step 1: Define Your Objectives and Identify Target Users

Define the objectives of your fintech app. What problem does it solve? What value does it provide to users?

Identify your target users and their needs. Conduct market research to understand your target audience, financial behaviors, and preferences.

Step 2: Develop a Business Plan

Create a comprehensive business plan that outlines your features of a fintech app, functionality, monetization strategy, and marketing plan.

Identify the resources, team, and budget needed for your fintech app development.

Step 3: Choose the Right Technology Stack

Select the appropriate technology stack for your fintech app, including programming languages, frameworks, databases, and third-party APIs.

Consider scalability, security, and user experience when choosing your technology stack.

Step 4: Design User Experience (UX) and User Interface (UI)

Create a user-friendly and visually appealing UX/UI design for your fintech app. Consider factors such as ease of use, intuitive navigation, and accessibility.

Develop wireframes and prototypes to visualize the app’s flow and functionality.

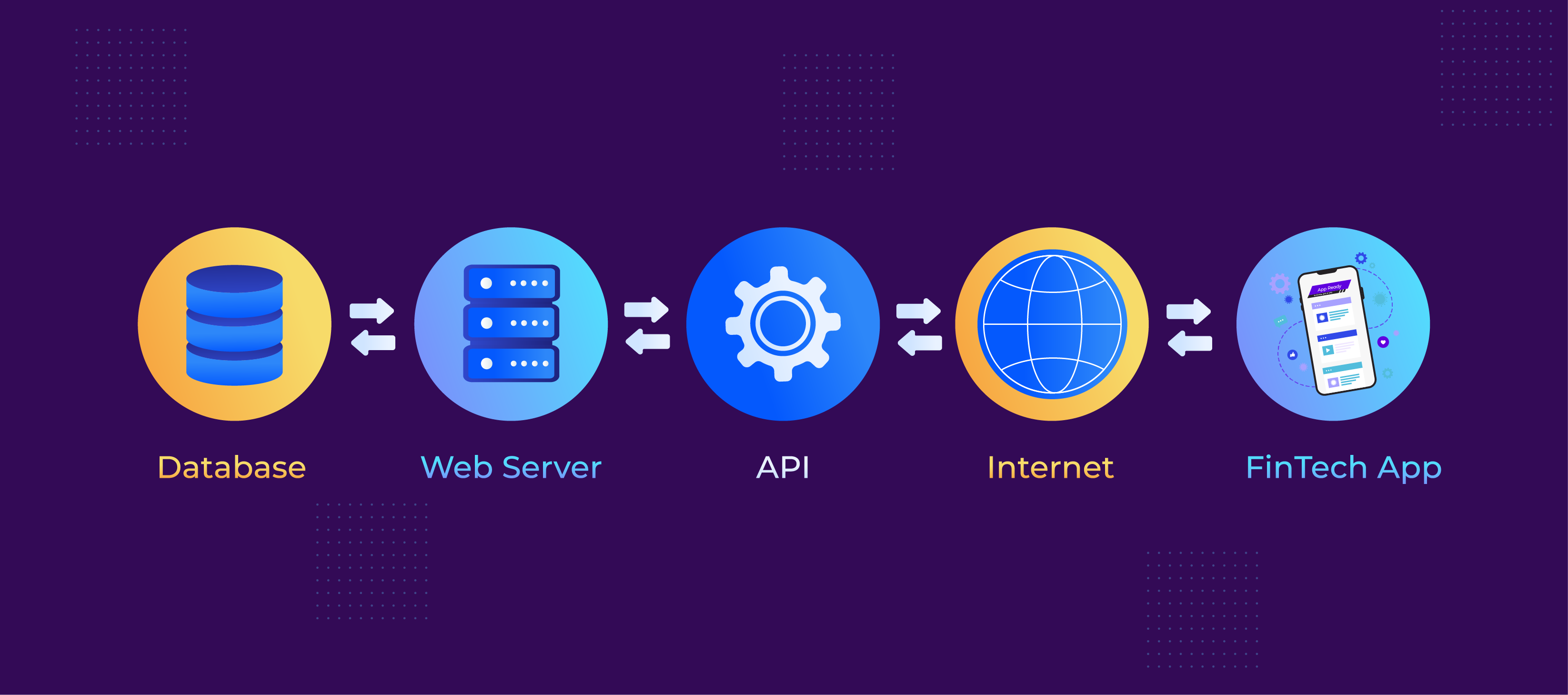

Step 5: Develop the Backend and Frontend

Develop the backend infrastructure that powers your fintech app, including server-side logic, APIs, and databases.

Develop the frontend components of your app, including the user interface and user experience design.

Step 6: Implement Security Measures

Implement robust security measures to protect sensitive financial data and ensure compliance with relevant regulations, such as encryption, authentication, and authorization.

Regularly test and audit the security of your app to identify and fix vulnerabilities.

Step 7: Test and Optimize

Conduct thorough testing of your fintech app to identify and fix any bugs or issues.

Optimize your app’s performance, speed, and user experience to ensure smooth and seamless functionality.

Step 8: Obtain Necessary Regulatory Approvals

Depending on the nature of your fintech app and the markets you operate in, you may need to obtain regulatory approvals, such as licenses or certifications, from relevant authorities.

Ensure compliance with applicable financial regulations, data protection laws, and other legal requirements.

Step 9: Launch and Market Your App

Once your fintech app is ready, launch it in the app stores or other distribution channels.

Implement a comprehensive marketing plan to promote your app, including digital marketing, content marketing, social media, and influencer partnerships.

Step 10: Monitor, Update, and Improve

Continuously monitor and analyze user feedback, app performance, and market trends.

Regularly update and improve your fintech app to enhance its features, functionality, and security based on user feedback and changing market needs.

Developing a fintech app requires careful planning, execution, and ongoing maintenance to ensure its success. It’s important to work with experienced developers, use the latest technology, and prioritize user experience and security.

Which Technology Stack is Best for Developing FinTech Applications?

There is no one-size-fits-all answer to which technology stack is best for developing fintech applications. The choice of technology stack will depend on several factors, such as the type of fintech app, the target market, and the development team’s expertise. However, here are some popular technology stacks used in fintech app development:

1. Backend Development:

Language: Java, Python, Ruby on Rails, Node.js, Go, PHP

Frameworks: Spring, Django, Ruby on Rails, Express, Laravel

Databases: PostgreSQL, MySQL, MongoDB, Cassandra, Redis

2. Frontend Development:

Languages: HTML, CSS, JavaScript

Frameworks: React, Angular, Vue.js

3. Mobile App Development:

Native App Development: Swift (iOS), Kotlin (Android)

Cross-Platform App Development: React Native, Flutter

4. Cloud Infrastructure:

Amazon Web Services (AWS)

Google Cloud Platform (GCP)

Microsoft Azure

5. Security:

SSL/TLS Encryption

OAuth 2.0

Two-Factor Authentication (2FA)

Encryption Algorithms: AES, RSA, SHA-256

When choosing a technology stack for your fintech app, consider scalability, security, performance, and ease of maintenance factors. Working with experienced developers and technology experts who can guide you in selecting the appropriate technology stack for your fintech app development needs is essential.

Conclusion

In conclusion, a well-designed fintech app with essential features of a fintech app for personal finance management can be a game-changer in helping users take control of their finances, make informed decisions, and achieve their financial goals. From seamless payments and transfers to budgeting tools, credit score monitoring, and personalized financial insights, a comprehensive fintech app can be valuable in managing one’s finances effectively.

As a leading fintech company, Pairroxz Technologies is committed to providing innovative and user-friendly fintech solutions to empower individuals in their financial journey. Explore our app today and easily experience the convenience and empowerment of managing your personal finances.

FAQs

Question 1: What are the essential features of a FinTech app for personal finance management?

The essential features of a FinTech app for personal finance management include budget tracking, expense management, bill payment reminders, investment tracking, financial goal setting, and transaction categorization.

Question 2: How can budget tracking help with personal finance management?

Budget tracking helps individuals keep track of their income and expenses, allowing them to identify areas where they can cut back and save money. It also provides a clear picture of where their money is going and helps them make more informed financial decisions.

Question 3: What is expense management, and why is it important in personal finance management?

Expense management involves tracking and categorizing expenses. This allows individuals to see where they spend their money and adjust as needed. Expense management is critical in personal finance management as it helps individuals understand their spending habits and identify areas where they can reduce expenses.

Question 4: What is a bill payment reminder, and how does it help with personal finance management?

A bill payment reminder are the features of a fintech app that notifies individuals of upcoming bills that need to be paid. This helps individuals avoid late fees and keep track of their bills. It also helps with personal finance management as it allows individuals to budget their bills and ensure they are paid on time.

Question 5: Why is investment tracking important in personal finance management?

Investment tracking allows individuals to keep track of their investments, including their performance and current value. This helps them make informed investment decisions and adjust their portfolio as needed. Investment tracking is important in personal finance management, allowing individuals to build wealth and achieve financial goals.

Question 6: What is financial goal setting, and why is it important in personal finance management?

Financial goal setting involves setting specific financial goals, such as saving for a down payment on a house or paying off debt. This helps individuals stay motivated and focused on achieving their financial goals. Financial goal setting is important in personal finance management as it allows individuals to prioritize spending and make decisions that align with their long-term financial objectives.

Question 7: How can transaction categorization help with personal finance management?

Transaction categorization involves categorizing transactions, such as food, transportation, or entertainment. This helps individuals track their spending in different categories and identify areas where they can reduce expenses. Transaction categorization is important in personal finance management as it provides a clear picture of where an individual’s money is going and helps them make informed financial decisions.