If your app deals in sales of any kind of products or services, integration of an appropriate payment gateway should be one of your major concerns. For an e-commerce platform, providing its users with a smooth and secure interface is a must.

We often stress on building an amazing UI while we forget to focus on a secure and convenient payment gateway into the app. Bestowing your customers with a good payment experience will be the cherry on the top of a cake.

Because if your app’s user has come all the way from selecting a product and adding it to cart to make the payment, they are just one step away from making their purchase. By offering them easy and secure payment options, you turn your user into a customer.

According to an estimation by Statista, “Total transaction value in the Digital Payments segment is projected to reach US$4,406,431m by the end of 2020.” Let’s discuss what factors make a payment gateway good choice for your business.

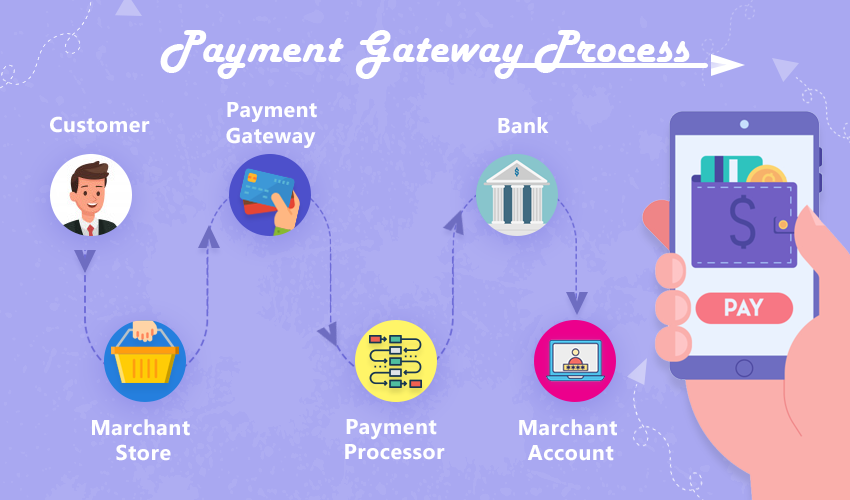

What’s A Good Payment Gateway?

You may ask what factors make a payment gateway good and how should you identify which payment gateway should you integrate into your app? Here’re some pointers that make a payment gateway a good choice for your app/website.

- The best payment gateways guarantee security and confidentiality. Your customers’ personal information and payment information should be confidential and protected at any cost.

- The top payment gateways provide transaction facility through multiple channels such as debit card, credit card, e-wallets, etc.

- The best payment gateways provide multi-layer security during online transactions.

- They also allow easy refunds if customer’s money is transacted due to a glitch or customer cancels the order.

- A good payment gateway should be compatible with your app and should have a good UI for you to operate your account effortlessly.

- The top payment gateways allow multi-currency transactions making offshore shopping easy for your users.

- Your payment gateway should be operating in the countries that your app is targeting.

Here’s our list of the top payment gateways based on various factors:

1. Stripe

Stripe is a cloud-based payment gateway that was launched in 2011. It allows its user to create a merchant account which acts as a mediary between the business and customers.

Stripe Features

- Stripe accepts various payment modes such as Visa, MasterCard, AmEx, multiple banks’ credit cards, and e-wallets like Google Pay and Apple Pay.

- The payment gateway Stripe is known for its industry-leading developer tools that make the gateway customizable to be matched with specific business/app requirements.

- Additionally, Stripe does not charge fees for account setup, cancellation, or maintenance.

- Stripe offers many other amazing features for its users. You can check the features in detail here.

- Stripe is available for business in 39 countries and deals in around 135 currencies.

- The factor that makes it widely popular is that this payment gateway accepts payment from anywhere in the world.

- The payment gateway Stripe has been created keeping businesses in mind with incredible API, ease of access, support for most types of payment modes and much more.

Countries Stripe is available in are:

Australia, Austria, Belgium, Brazil (PREVIEW), Bulgaria, Canada, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, India (PREVIEW), Ireland, Italy, Japan, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, United States

Fee and Charges:

Stripe’s transaction fee and prices are different for each country that it is available in. You can always check the prices in your country on https://stripe.com/en-in/pricing.

2. Paypal

Paypal is the second most popular payment gateway on our list. Paypal was established in 1998 and later became a subsidiary of eBay in 2002. It has been providing a digital alternative to the traditional payment methods for over a decade now. You can simplify online payments for your users with the payment gateway and merchant account created in Paypal.

Paypal Features

- Paypal is one of the simplest and most used payment gateways. Over all these years, it has gained credibility and love from its users.

- Being one of the earliest payment gateways to provide in-app and web payment gateway integration, The payment gateway Paypal is now operating in 200 countries and deals in 25 currencies.

- Paypal allows you to create an internet account and manage your finances transaction within the platform.

- It supports international transactions and charges a nominal fee for it.

- Paypal is an extremely secure platform that offers multiple layers of protection for your personal cards and account info.

- Adding Paypal into your website or app is an effortless process. Developers simply have to copy and paste some lines of codes from the payment gateway Paypal to their codes and add different buttons including Buy Now, Add to Cart, Subscribe, and Automatic Billing etc. Paypal ensures 24/7 fraud protection and global customer support.

Countries Paypal is available in:

Paypal is available in many countries of Asia Pacific, Africa, Europe and Both the Americas. You can find out whether your country is one of them or not here.

Fee and Charges:

Setting up an account, cancellation of account or its maintenance is not chargeable however Paypal imposes a nominal transaction fee on every transaction made via the platform.

For Local Payments: Fixed 2.5% + ₹3

For International Payments: From 3.4% + fixed currency fee

3. Braintree

Braintree is a part of Paypal services.

- Braintree represents itself as a global payments partner that allows you to transact globally using various payment modes including Paypal, Google Pay, Apple Pay, credit and debit cards, etc.

- It is aimed at providing a complete payment solution for businesses.

- Braintree allows seamless business payment gateway integration where a business can manage internal expenses and automate their back-end process.

- Braintree comes with a convenient ready-made UI that makes the integration easier for a payment gateway online.

Countries Braintree is available in:

Braintree is available for merchants in 40 countries including the United States, Canada, Australia, Europe, Singapore, Hong Kong SAR China, Malaysia, and New Zealand. It supports 130 currencies worldwide.

Fee and Charges:

Braintree imposes a fee of 2.9% + $.30 per transaction*

with No minimums, no monthly fees, and no hidden fees.

4. BlueSnap

BlueSnap advertises itself as an all-in-one platform that accepts payments globally for subscriptions, marketplaces, invoices, and to help businesses to increase their sales and reduce costs.

- BlueSnap account is associated with a network of many banks globally to scale a higher number of customers from around the world.

- It offers intelligent payment routing to improve authorization and cost.

- The gateway supports 100+ global payment types and e-wallet.

- BlueSnap allows easy integration with any platform in a simple single step. The SDK is available on GitHub.

- Intelligent payment routing, Marketplace payments, Subscriptions, Multi-currency reporting, Hosted solutions, Hosted fields, 3-D Secure and PSD2 compliance, Integrated payments, Invoice payments, Cross-channel payments are some of the features that BlueSnap offers.

Countries BlueSnap is available in:

BlueSnap operates in 180 countries and 100 currencies from around the world. You can check whether or not it supports your country here and currency here.

Fee and Charges:

For Visa, Mastercard, Discover, Diners, JCB, American Express: 2.90% + $0.30

- No monthly fees (during first 12 months or if processing >$2500/mo)

- No set-up fees, no cancellation fees

- Cross-border and currency fees may apply

- No additional fees for processing eWallets

5. Checkout.com

Checkout.com is a payment gateway that provides various payment solutions for e-commerce businesses.

Checkout.com accepts the majority of debit and credit cards from around the globe. This service is available in the following countries:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States, Australia, China, Hong Kong, Japan, Malaysia, New Zealand, Singapore, Bahrain, Egypt, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

The payment gateway also deals with many digital wallets used in different countries. The facility is available in the below-mentioned countries:

Austria, Belgium, Brazil, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, The United Kingdom, and The United States.

It allows for easy integration of various local payment methods. This facility is available in the following countries:

Austria, Belgium, Brazil, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, The United Kingdom, and The United States.

If you are willing to integrate domestic cards into your payment gateway for e-commerce platforms and you are a resident of any of the below-mentioned countries, you can avail this facility.

Belgium, France, Portugal, Kuwait, Oman, Qatar, and Saudi Arabia.

Checkout.com also allows you to incorporate stored-value digital wallets into your app or website in below-mentioned countries.

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States, Australia, China, Hong Kong, Japan, Malaysia, New Zealand, Singapore, Bahrain, Egypt, Kuwait, Oman, Qatar, Saudi Arabia, and The United Arab Emirates.

- Checkout is one of the most sought after payment gateway owing to the range of payment services that it offers.

- This payment gateway online is also a great one to be integrated into your app if your business operates or has the target audience in any of the above countries.

- Checkout.com professes seamlessly connected payment solutions for agile, global business.

Fee and Charges:

Checkout.com price a business based on the business profile and risk category. Their pricing model includes card association fee, processing fee, and interchange fee.

- No setup fees

- Full visibility into card schemes and costs

- No surprise fees

- Integrated with all major shopping carts

- Data migration assistance

- Risk and fraud management tools included

- No account maintenance fees

- Knowledgeable integration support

- Dedicated account management and service

6. PayFast

Last but not least on our list is PayFast. South Africa is one of those countries that lack the availability of many technologies and advanced apps. Even widely available payment gateways like Paypal and Bluesnap are not operative in South Africa.

Hence, if you are doing your business in South Africa, PayFast is the best payment gateway that you should integrate into your app.

- This payment gateway offers fast and secure online payment solutions to businesses in SA.

- They provide instant payment processing facility and the gateway can be incorporated into apps as well as in websites.

- Their payment facilities are available for e-commerce, event ticketing, invoicing, and for accepting donations online.

- It also allows its users to split payment with a 3rd party.

- The payment gateway enables developers to integrate shopping carts and Pay Now buttons easily.

- It even allows them to create custom integration or list plugins on PayFast.

Fee and Charges:

PayFast’s fee is negotiable. They charge on every successful transaction without any hidden fee, setup fee, or cancellation fee. They have a varied range of fees for different types of payment modes. You can look up the transaction fee and charges here.

Conclusion

The availability of payment gateways in the market is huge. Most payment gateways operate in different regions. While the majority of them accept payments from anywhere in the world once you are able to create an account on them. However, if you do not belong to the country a payment gateway is available in, there is practically nothing you can do about it.

Hence, it is always best to study your target market and identify your target audience and countries before selecting the most suitable payment gateway for your app. Your business’s funnel to bring in the profits would be the payment gateway that you will select.

If you are unsure and unable to decide the best payment gateway for your app, you can contact us. We have been creating apps for various countries around the world, integrating the most suitable payment gateways for each one of them based on their target market and region(s).